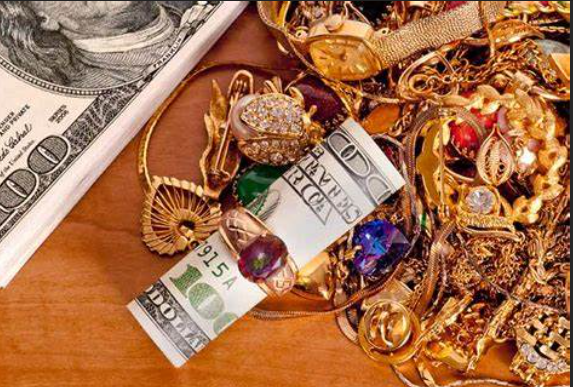

In today’s ever-evolving financial landscape, individuals often find themselves in need of immediate cash flow. Exploring unconventional yet practical methods to secure loans has become imperative. One such avenue gaining momentum is leveraging the worth of jewellery to obtain loans swiftly and conveniently. This process involves collaborating with reputable gold buyers who understand the intrinsic value of these possessions beyond their aesthetic appeal.

The concept of obtaining a loan against jewellery is a viable option for individuals seeking immediate financial assistance without resorting to traditional bank loans or high-interest credit cards. By utilizing jewellery items—be it gold, silver, diamonds, or other precious stones—as collateral, individuals can obtain loans quickly and efficiently.

When considering a loan on jewellery, the key aspect lies in collaborating with trustworthy gold buyers. These professionals assess the value of the jewellery based on its purity, weight, and market value. The evaluation process ensures that clients receive a fair loan amount commensurate with the actual worth of their possessions.

Gold buyers play a pivotal role in facilitating this process by offering transparent evaluations and providing loans at competitive interest rates. Their expertise in appraising various jewellery items allows borrowers to leverage their assets effectively without compromising on their value.

The advantages of obtaining a loan on jewellery are multifaceted. Firstly, it provides a means to access immediate funds without undergoing extensive credit checks or bureaucratic processes commonly associated with conventional loans. Secondly, it offers a confidential and discreet solution for individuals who prefer to keep their financial matters private. Moreover, since the loan is secured against the jewellery, it often involves lower interest rates compared to unsecured loans.

Understanding the nuances of this financial transaction is crucial for both borrowers and gold buyers. Borrowers need to comprehend the terms and conditions of the loan, including the repayment schedule and consequences of default. Meanwhile, gold buyers must maintain transparency throughout the appraisal and lending process, ensuring a fair and ethical transaction for all parties involved.

The process of obtaining a loan on jewellery begins with the assessment of the items offered as collateral. Gold buyers meticulously examine the quality, purity, and market value of the jewellery to determine the loan amount. Once the evaluation is complete and terms are agreed upon, borrowers receive the loan amount promptly, providing a quick solution to their financial needs.

The convenience and accessibility of this financial avenue have contributed to its growing popularity. Individuals facing emergencies or requiring immediate funds often turn to loan options against jewellery due to their expediency and hassle-free nature.

In conclusion, the concept of obtaining a loan on jewellery presents a practical and efficient solution for individuals seeking immediate financial assistance. Collaborating with reputable and transparent gold buyers ensures a fair appraisal and a seamless lending process. This avenue not only provides quick access to funds but also allows individuals to leverage their valuable assets effectively in times of need.

As with any financial transaction, thorough understanding and diligence are paramount. Individuals considering a loan on jewellery should conduct proper research, choose reputable gold buyers, and ensure they fully comprehend the terms and conditions before proceeding. Ultimately, when utilized judiciously, a loan against jewellery can serve as a valuable resource in managing financial exigencies.