Are you looking for a convenient and efficient way to handle your business payments? QB voucher checks might just be the solution you need. In this post, we will explore the benefits of QuickBooks checks and how they can streamline your payment processes. From understanding what voucher checks are to their advantages, we will cover everything you need to know. So, let’s dive in!

QuickBooks Voucher Checks

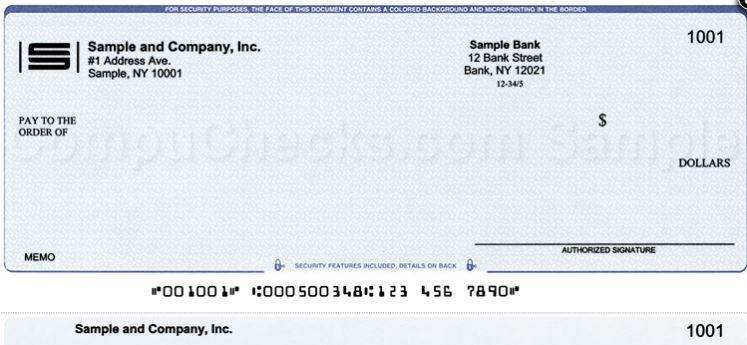

QuickBooks voucher checks are specialized checks that are designed to work seamlessly with the QuickBooks accounting software. They provide an all-in-one solution for managing your payments, recording transactions, and maintaining financial records.

When you write a voucher check using QuickBooks, the software automatically records the transaction details and updates your accounts. This eliminates the requirement of manually entering data and decreases the likelihood of errors. QB voucher checks come with detachable vouchers that contain important payment information, making it easy to keep track of your expenses.

The Benefits of Voucher Checks

Using QuickBooks voucher checks offers several benefits for businesses:

a) Time-Saving Convenience

QuickBooks checks streamline your payment processes by automating data entry. You can print checks directly from QuickBooks, saving time and effort compared to writing checks by hand.

b) Accuracy and Error Reduction

With voucher checks, the chances of errors in your payment records are significantly reduced. The software automatically updates your accounts when you write a check, ensuring accurate financial information.

c) Professional Appearance

QB voucher checks are designed to look professional and include your business information, logo, and branding. This adds a level of credibility to your payments and enhances your professional image.

d) Easy Expense Tracking

The detachable vouchers on these checks allow you to easily track your expenses. You can keep a record of payment details, such as the payee, amount, and purpose of the payment.

e) Seamless Integration

QuickBooks checks integrate seamlessly with the QuickBooks software, providing a cohesive solution for managing your finances. You can access all your payment records and financial information in one place.

Enhancing Security with QuickBooks Voucher Checks

Security is a top priority when it comes to business payments. QuickBooks voucher checks offer enhanced security features to protect your transactions:

a) Fraud Prevention

QuickBooks vouchers are equipped with security features, including watermarks, microprinting, and tamper-evident packaging. These measures help prevent fraud and unauthorized alterations to your checks.

b) Secure Blank Check Stock

QuickBooks checks are printed on high-quality blank check stock that meets industry standards for security. This ensures that your checks are resistant to tampering and counterfeiting.

c) Secure MICR Encoding

The Magnetic Ink Character Recognition (MICR) encoding on these voucher checks adds an additional layer of security. MICR technology allows for accurate and secure check processing by financial institutions.

Customization Options for These Voucher Checks

QB voucher checks can be customized to suit your business needs:

a) Logo and Branding

You can include your business logo and branding on your voucher checks, giving them a professional and personalized touch.

b) Business Information

QuickBooks checks allow you to include your business information, such as the company name, address, and contact details.

c) Check Design

You can choose from a variety of check designs and layouts that align with your brand identity.

How to Order These Checks?

Ordering QuickBooks voucher checks is a straightforward process:

a) Choose a Reputable Supplier

Select a reputable supplier or authorized vendor that specializes in QB voucher checks.

b) Customize Your Checks

Provide your business information, logo, and any additional customization preferences to the supplier.

c) Place Your Order

Place your order with the supplier, specifying the number of voucher checks you require.

d) Receive Your Checks

Once your order is processed, you will receive your voucher checks at your specified delivery address.

QuickBooks Voucher Checks vs. Traditional Checks

QuickBooks voucher checks offer several advantages over traditional checks:

a) Efficiency

QB voucher checks automate the payment process, reducing the time and effort required to write and record checks manually.

b) Accuracy

By eliminating manual data entry, voucher checks minimize the risk of errors and ensure accurate financial records.

c) Integration

QuickBooks vouchers seamlessly integrate with the QuickBooks software, providing a unified solution for managing payments and accounting.

Tracking Expenses and Payments with QuickBooks

These voucher checks provide robust expense and payment tracking capabilities:

a) Categorizing Expenses

You can categorize your expenses in QuickBooks, making it easier to track and analyze your spending patterns.

b) Vendor Management

QuickBooks allows you to manage your vendors, track payments to suppliers, and maintain a comprehensive vendor database.

c) Payment Reminders

You can set up payment reminders in QuickBooks to ensure timely payments and avoid late fees.

Integrating Voucher Checks with Accounting Software

QuickBooks voucher checks seamlessly integrate with various accounting software systems, allowing for streamlined financial management:

a) Account Reconciliation

You can reconcile your bank accounts with QuickBooks, ensuring that your records match your bank statements.

b) Financial Reporting

QuickBooks generates comprehensive financial reports, providing insights into your business’s financial health and performance.

c) Tax Preparation

With QuickBooks, you can simplify your tax preparation by generating accurate financial reports and organizing your financial data.

Tips for Using Voucher Checks Effectively

To make the most of QuickBooks voucher checks, consider the following tips:

a) Regular Backups

Back up your QuickBooks data regularly to prevent any loss of important financial information.

b) Stay Updated

Keep your QuickBooks software up to date to ensure you have access to the latest features and security enhancements.

c) Train Your Staff

Provide training to your employees on how to use QuickBooks checks effectively to maximize their benefits.

d) Reconcile Accounts Regularly

Regularly reconcile your bank accounts in QuickBooks to ensure accurate financial records and identify any discrepancies.

e) Seek Professional Assistance

If you’re new to QuickBooks or need help with its advanced features, consider consulting with a QuickBooks expert or accountant.

Conclusion

QuickBooks voucher checks offer a comprehensive solution for managing your business payments effectively. With their time-saving convenience, accuracy, and seamless integration with the QuickBooks software, voucher checks simplify your payment processes and enhance financial management. By customizing your checks and taking advantage of the security features, you can ensure professional and secure transactions. Streamline your business payments today with QuickBooks checks!