In today’s dynamic financial landscape, trading on a CFD (Contract for Difference) platform has gained immense popularity. CFD trading allows traders to speculate on the price movements of various assets, including stocks, commodities, currencies, and indices, without owning the underlying assets. This flexibility, coupled with the potential for high returns, has made CFD trading a preferred choice for both novice and experienced traders.

In this comprehensive guide, we will delve deep into the world of CFD trading platforms, exploring what they are, how to choose the best CFD trading platform, and strategies to maximize your success.

Understanding CFD Trading Platforms

What Is A CFD Trading Platform?

A CFD trading platform is an online software or application that provides traders access to the global financial markets. These platforms offer a wide range of financial instruments that traders can speculate on, using CFDs. The primary goal of a CFD trading platform is to facilitate the buying and selling of CFD contracts, enabling traders to profit from price fluctuations in various assets.

How Does Cfd Trading Work?

At its core, CFD trading is a contract between a trader and a CFD provider, typically a broker. This contract mirrors the price movements of an underlying asset. When traders open a CFD position, they are essentially betting on whether the asset’s price will rise (going long) or fall (going short). The profit or loss is determined by the difference between the entry and exit prices.

Benefits Of Trading On A CFD Platform

Leverage: CFD trading allows traders to control larger positions with a relatively small amount of capital. This leverage amplifies potential profits but also increases the risk of significant losses.

Diverse Asset Selection: CFD platforms offer access to a wide range of assets, including stocks, commodities, indices, and cryptocurrencies. This diversity provides ample opportunities for traders.

Short Selling: CFDs allow traders to profit from falling prices by going short. This ability to capitalize on both rising and falling markets adds flexibility to trading strategies.

Hedging: Traders can use CFDs to hedge their existing portfolios. By taking opposite positions in CFDs and physical assets, traders can protect their investments from adverse price movements.

No Ownership Required: Unlike traditional investing, CFD traders do not need to own the underlying assets. This eliminates the need for storage, paperwork, and other hassles associated with physical ownership.

24/5 Market Access: CFD markets operate 24 hours a day, five days a week, allowing traders to react to global events and news in real-time.

Choosing the Best CFD Trading Platform

Selecting the right CFD trading platform is crucial for your success as a trader. Here are the key factors to consider when evaluating different platforms:

Regulation And Security

Before anything else, ensure that the CFD trading platform is regulated by a reputable authority. Regulatory bodies like the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US impose strict guidelines on CFD providers to protect traders. A regulated platform provides you with a level of security and transparency.

Asset Availability

Evaluate the range of assets offered by the platform. The best CFD trading platforms provide access to a diverse selection of assets, allowing you to diversify your portfolio and trade what suits your strategy best.

Trading Fees

Understanding the fee structure is crucial. Look for platforms with competitive spreads, low commissions, and minimal overnight financing costs. High fees can eat into your profits, so it’s essential to choose a platform with cost-effective pricing.

User-Friendly Interface

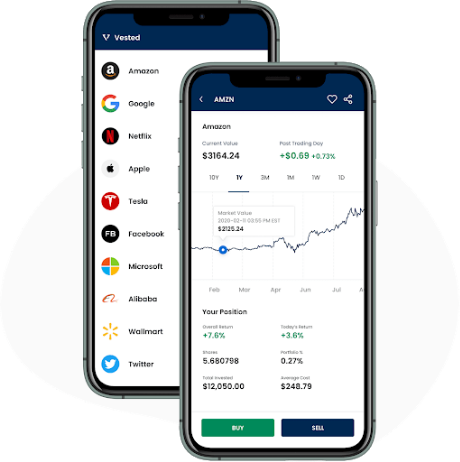

A user-friendly interface is vital, especially if you are new to CFD trading. The platform should be intuitive and easy to navigate. Look for features like customizable charts, technical analysis tools, and a mobile app for trading on the go.

Risk Management Tools

The best CFD trading platforms offer a range of risk management tools to help protect your capital. These may include stop-loss orders, take-profit orders, and guaranteed stop-loss orders. These tools allow you to automate aspects of your trading strategy and limit potential losses.

Customer Support

Prompt and effective customer support is essential, especially when you encounter technical issues or have questions about your trades. Test the platform’s customer support through their available channels (e.g., live chat, email, phone) to ensure they are responsive and knowledgeable.

Educational Resources

For traders of all levels, access to educational resources is invaluable. Look for platforms that provide educational materials such as webinars, video tutorials, and written guides. These resources can help you enhance your trading skills and knowledge.

Demo Account

Many CFD trading platforms offer demo accounts, allowing you to practice trading with virtual funds. This is an excellent way to familiarize yourself with the platform’s features and test your trading strategies without risking real money.

Execution Speed And Reliability

Fast and reliable order execution is critical, especially for day traders and scalpers. Ensure that the platform has a history of stable performance and minimal downtime during high volatility periods.

Mobile Trading

In today’s fast-paced world, the ability to trade on the go is a significant advantage. Look for a platform that offers a mobile trading app compatible with your smartphone or tablet.

Strategies for Successful CFD Trading

Now that you’ve chosen the best CFD trading platform that suits your needs, let’s explore some strategies to help you succeed in CFD trading.

Develop A Trading Plan

Before you start trading, create a well-defined trading plan. This plan should outline your goals, risk tolerance, and preferred trading strategies. Having a plan in place helps you stay disciplined and avoid impulsive decisions.

Risk Management

Effective risk management is crucial in CFD trading. Only risk a small percentage of your capital on each trade, typically no more than 2-3%. Use stop-loss orders to limit potential losses and protect your trading capital.

Technical And Fundamental Analysis

Utilize both technical and fundamental analysis to make informed trading decisions. Technical analysis involves studying price charts and indicators, while fundamental analysis considers economic events and news that may impact the markets.

Diversification

Avoid putting all your capital into a single asset. Diversify your portfolio across different assets to spread risk. A well-diversified portfolio can help protect your capital during market volatility.

Keep Learning

The financial markets are constantly evolving. Continuously educate yourself about new trading strategies, market trends, and economic events that could influence your trades. Staying informed is key to success.

Emotional Discipline

Emotions can cloud your judgment and lead to impulsive decisions. Stick to your trading plan, and don’t let fear or greed drive your actions. Maintain emotional discipline, even when facing losses.

Backtesting

Before implementing a new trading strategy, backtest it using historical data to see how it would have performed in the past. This can help you identify the strengths and weaknesses of your strategy.

Stay Informed

Keep abreast of global news and events that could impact the markets. Economic data releases, geopolitical developments, and central bank decisions can all influence asset prices.

Practice Patience

Trading can be both exciting and challenging. Exercise patience and avoid overtrading. Wait for the right opportunities and execute your trades with a calm and composed mindset.

Review And Adapt

Regularly review your trading performance and adapt your strategies as needed. Learning from your mistakes and making necessary adjustments is essential for long-term success.

Conclusion

Trading on a CFD platform offers a world of opportunities for both novice and experienced traders. By understanding the fundamentals of CFD trading, choosing the best CFD trading platform, and implementing effective strategies, you can navigate the financial markets with confidence. Remember that success in CFD trading requires discipline, continuous learning, and a well-thought-out approach. As you embark on your CFD trading journey, stay informed, manage your risks wisely, and never stop improving your skills to become a successful trader in the exciting world of CFDs.